No one likes to pay for insurance, but everybody loves having it when the need arises.

- Start with a free $1,000 policy for accidental death and dismemberment protection just for being a 1st Cooperative member. Add more if needed.

- Car, home and life insurance covers three important parts of our lives.

- Protect your credit history with insurance to repay your loan if you can’t due to sickness, disability or death.

- Mechanical repair coverage covers those unexpected big vehicle repairs.

Accidental death & dismemberment insurance

It’s free for members.

Complete an enrollment form, and you will qualify for $1,000 of 24-hour accidental death and dismemberment insurance at no cost.

You may also purchase additional coverage or a family plan.

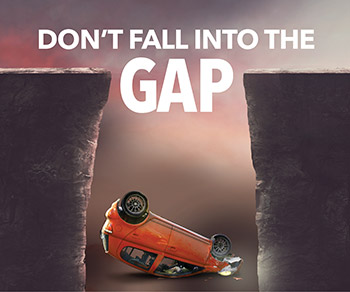

Guaranteed Auto Protection (GAP)

If you think your auto insurance covers you financially, think again.

The GAP reimbursement program pays the difference between your loan balance and your insurance company’s settlement payment if your vehicle is totaled in an accident or stolen and not recovered.

Credit insurance

It pays your loans when you can’t.

Protect your creditworthiness, and get help repaying a loan during a disability or sickness or if you die before the balance is paid. There are two types of protection for both consumer loans and credit card debt.

Auto and home insurance

Affordable plans, trusted source.

TruStage Insurance has connected with 1st Cooperative FCU to provide you the best insurance coverage and pricing available.

Whole life and term life insurance

Expect the best, prepare for the worst.

Think ahead. Plan wisely. Protect your family in case you don’t live to see your and their dreams come true.

Mechanical repair coverage

Help protect your vehicle.

As your vehicle gets older, the risk and cost of repairs increases. Repair coverage can protect you from those costs, with three levels of coverage to choose from: Easy Street, Main Street and First Street.

Guaranteed Auto Protection (also known as Guaranteed Asset Protection) is a loan/lease deficiency waiver and is not offered as insurance coverage. This product is offered through Evans, Simpson and Associates. Mechanical Repair Coverage is provided and administered by Route 66 Warranty. AD&D insurance is underwritten by Minnesota Life Insurance Company. Franklin Madison Group LLC is the Plan Administrator. Credit Insurance is offered through CUNA Mutual Group and is underwritten by CMFG Life Insurance Company. TruStage® insurance products and programs are made available through TruStage Insurance Agency, LLC. Life insurance is issued by CMFG Life Insurance Company and other leading insurance companies. Auto and Home Insurance is underwritten by Liberty Mutual Insurance Company or its subsidiaries or affiliates. The insurance offered is not a deposit, and it is not federally insured, sold or guaranteed by this credit union.

Insurance and warranty products are not products of the credit union and are not obligations of or guaranteed by the credit union. Insurance or warranties may be purchased from an agent or an insurance company of the member’s choice, and the credit union makes no representations as to the services of any provider.

contact us

to ask about insurance.

CALL US

803-796-0234 M-F, 8:30 a.m. – 5 p.m.